Today’s Top Story

Santa Cruz Wharf Partially Collapses as Pacific Storm Pounds California's Coast

Two people were rescued when the Santa Cruz Wharf partially collapsed and fell into the ocean Monday, as California's coast was pounded by heavy surf from a major Pacific storm that's expected grow more intense throughout the day.

Latest News

Stay informed! Join our newsletter to get Bay Area news stories, special offers, and KQED programming highlights.

To learn more about how we use your information, please read our privacy policy.

Signed up.

Housing Affordability

Immigration

KQED Original PodcastsKQED Original Podcasts

Sponsored

More Top Stories

Santa Cruz Wharf Partially Collapses as Pacific Storm Pounds California's Coast

Two people were rescued when the Santa Cruz Wharf partially collapsed and fell into the ocean Monday, as California's coast was pounded by heavy surf from a major Pacific storm that's expected grow more intense throughout the day.

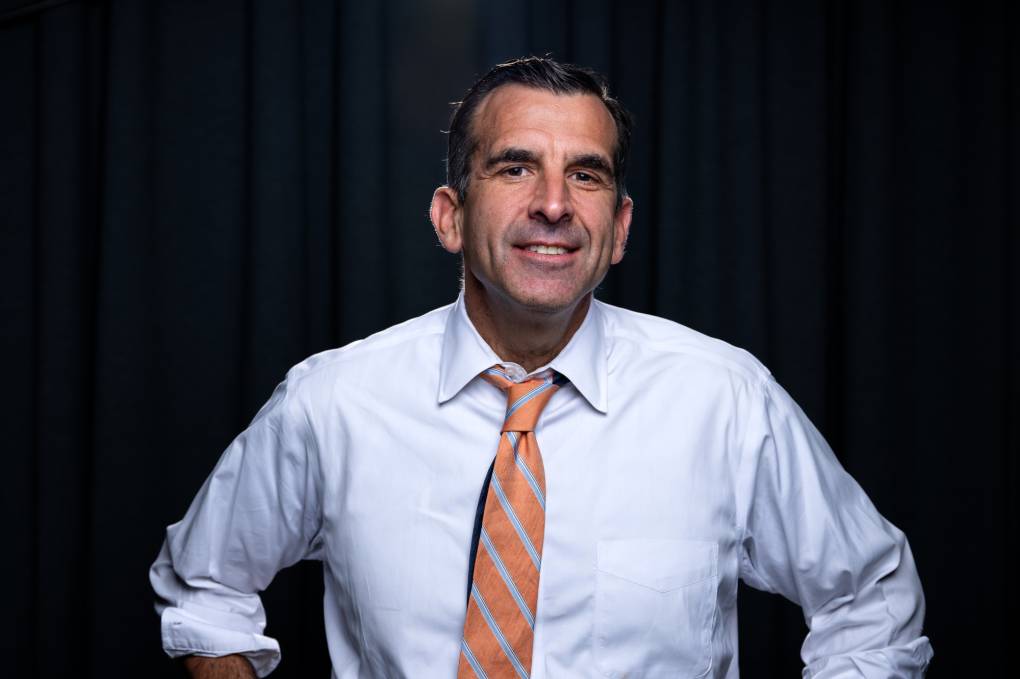

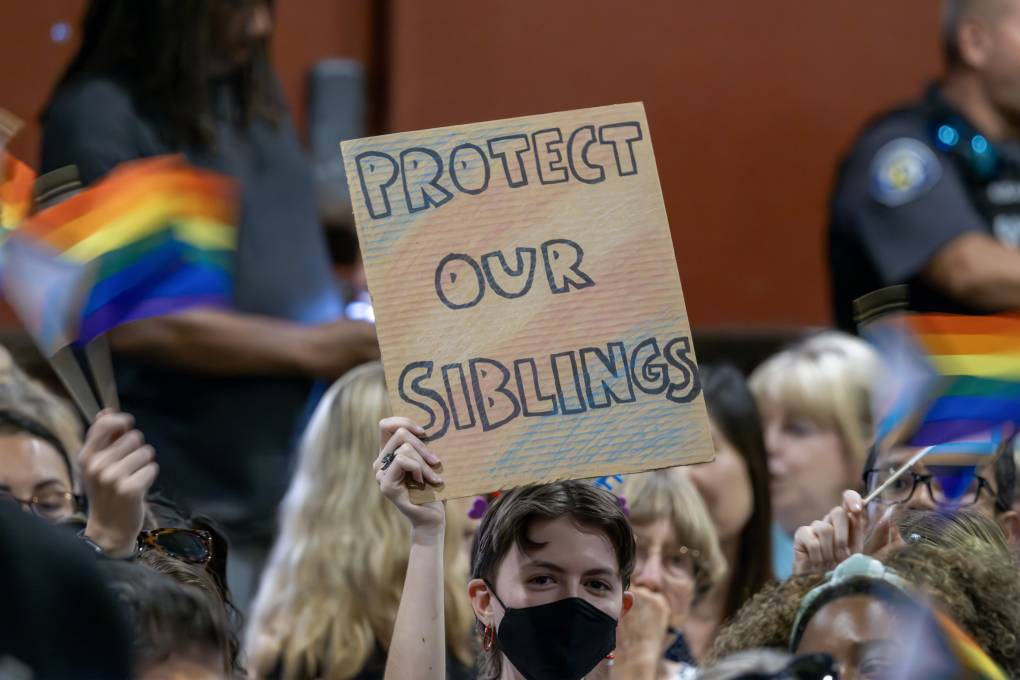

California Bans Schools From Forcing Teachers to 'Out' LGBTQ Students

New California law prevents schools from requiring staff to notify parents if a student identifies as LGBTQ. It’s in response to some districts requiring staff to notify parents when students identify as a gender other than what’s in their official files.